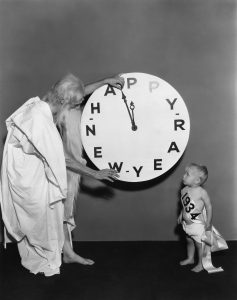

Welcome Baby New Year!

Hello 2020! A bright shiny New Year and the start of a new decade. Personally we have made our resolutions and are embarking the journey into our next revolution around the sun. For our businesses year end signals the need to address once a year tasks and prepare for the year to come.

Year end is a good time to get your files (physical and digital) refreshed and ready for a new year. Unless you are completely paperless, and if you are please let me know how you did it, there are paper files to be dealt with. If you are keeping more than seven years of documentation and you have a large quantity to be destroyed, maybe it is time to schedule a shredding service. Many of them will come to your place of business to either pick up for destruction or, if you request, destroy the paperwork right at your place of business.

Now is the time to physically archive your files, moving prior years’ to banker boxes and storage and setting up nice new files for the New Year. If there is room, I find it is nice to keep the prior years’ files in a more easily accessible location at least for the first 6 months of the New Year before moving them to storage.

As I move old files to a new location, I look to see if adjustments are needed to my current filing system. Is there a file of paid bills called “Supplies”? If by the end of the year it is bulky and unmanageable, maybe you determine if it makes sense to make separate files by vendor for the New Year. One of my clients is a manufacturer. Generally materials and services are purchased from the same suppliers every year. Locating an old invoice is much easier if the number of different vendors in the “Supplies” file is smaller and if major suppliers have their own file.

Another once a year task is generating W-2s and 1099s. Most likely you have an accountant or bookkeeper who handles this, however it will improve their efficiency if you confirm you have all the documentation they need for the process early in the year. This is a good time to follow up with former employees for updated address information. This is particularly true if the reason they are no longer employed is because they moved or retired.

Speaking of taxes, are you aware that in 2020 a new W4 form will be required for new employees and any employees whose status has changed. Visit the IRS website for more information: https://www.irs.gov/newsroom/faqs-on-the-2020-form-w-4

For Contractors (1099s), a good practice going forward is to request their W9 information when they first begin working with you. You can then forward it to your accountant when you start issuing checks to them and at the end of the year, you and the accountant will have current information.

If you are a sub-contractor to another business, get in the habit of sending them your W-9 when they sign your contract so they have accurate information.

This is also a good time to look at your digital files and organize them so that each time you are trying to locate a file you don’t have to scroll through all the previous year’s files to find it.

If you are like me and subscribe to email newsletters and never read them, now is a good time to reduce the number of emails landing in your inbox each day. As these emails hit your inbox, look at each one and determine right then if you read it. If you have subscribed for a year and still haven’t read one, go to the bottom of the newsletter and click “Unsubscribe”.

Need a hand going into 2020 as a more organized business person? Contact me at vicki@youdeserveahand.com for more information.